Filing ITR is more than just a legal task. It’s about showing you are financial responsibility and future-ready.

Filing your Income Tax Return (ITR) is not just a legal requirement; it’s proof of your legal responsibility. Whether you are salaried, a freelancer, or a business owner, filing your ITR helps you claim any refund due and builds a strong financial history.

Think of it as an annual financial health check-up. Just like a medical check-up that keeps you fit, ITR filing keeps your money matters in shape.

What is ITR?

An Income Tax Return (ITR) is a form you file with the Income Tax Department to record:

- Your total income

- Tax-saving deductions

- Taxes already paid (like TDS)

In short, ITR is your income report card for the government to check whether you owe more tax or deserve a refund

Who should file an ITR?

You must file ITR if:

- Your Income is above:

- ₹2.5 lakh (individuals)

- ₹3 lakh (senior citizens)

- ₹5 lakh (super senior citizens)

- You want to get a refund of the extra tax deducted.

- You own property/income outside India.

- You want to carry forward business or capital losses.

- You deposited ₹1 crore+ in a bank, spent ₹2 lakh+ on foreign trips, or paid electricity bills over ₹1 lakh.

- You are a company or firm (always mandatory).

Important Note:

Even if your income is below the taxable limits, you may need to pay advance tax. Also note that 15th September 2025 is the due date for the second installment of advance tax.

What are the Benefits of Filing ITR?

- Stay on the Right Side of the Law – Avoid penalties and notices.

- Get Easy Loans & Visas – Banks and embassies trust ITR as income proof.

- Refunds Come Back to You – Don’t let extra TDS go to waste.

- Carry Forward Your Losses – Save today to adjust tomorrow.

- Financial Identity – Shows your creditworthiness.

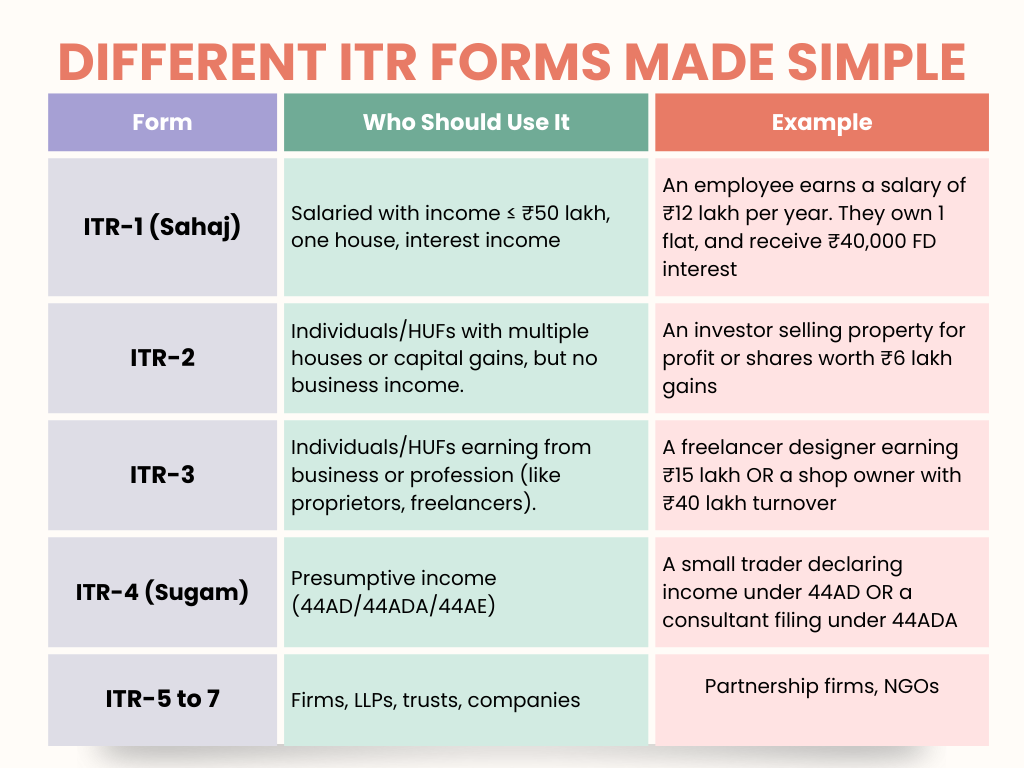

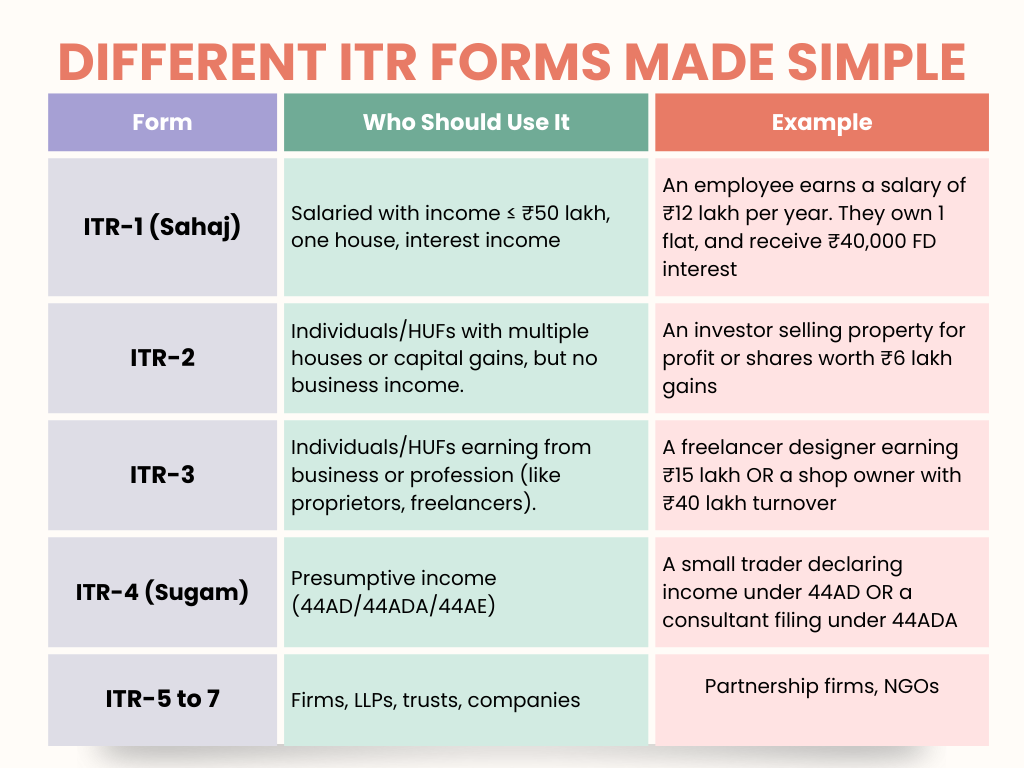

What are the different ITR Forms?

In India, the Income Tax Department has introduced 7 types of ITR forms for Assessment Year (AY) 2025–26. Each form is specifically designed for different categories of taxpayers based on their source of income, profession, and entity type.

What are the Important Deadlines that You Can’t Miss?

Here are the important due dates for AY 2025-26

- 15th September 2025: This is the last date for the second installment of advance tax (most important for businesses and professionals).

- 31st July 2025: For Individuals (non-audit cases).

- 31st October 2025: For Businesses requiring an audit.

- 30th November 2025: For Transfer pricing cases.

Important:

Missing the 15th September deadline means you’ll have to pay interest under Section 234C.

What are the Penalties for Late ITR Filing?

- Fine of ₹5,000 if your income is above ₹5 lakh.

- Fine of ₹1,000 if income is below ₹5 lakh.

- Extra interest under Sections 234A, 234B & 234C.

Documents Required for ITR Filing

- PAN & Aadhaar

- Form 16 (salary proof)

- Bank/interest certificates

- Capital gain statements (if you sold property/shares)

- Proof of investments (LIC, ELSS, PPF, etc.)

- Rent, EMI, or donation receipts

- Foreign income/asset details (if any)

What is a Step-by-Step Guide to Filing ITR Online?

Filing ITR may sound technical, but here’s a simple walk-through:

Step 1: Register/Login on the Income Tax Portal

- Visit https://www.incometax.gov.in

- Register using your PAN (if a new user). If already registered, log in with PAN, Aadhaar-linked mobile OTP, or password.

Step 2: Choose “e-File” → “Income Tax Return”

- Select “Assessment Year 2025-26” (for income earned in FY 2024-25).

- Pick the right ITR form (see Section 4 above).

Step 3: Select the Filing Type

- Choose “Original” return if filing the first time.

- Choose “Revised” if correcting a previously filed return.

Step 4: Fill in Your Income Details

- Salary income (auto-fetched from Form 16).

- Interest income (bank details).

- Capital gains (if you sold shares/property).

- Other income (like freelance work or rent).

Step 5: Claim Deductions & Exemptions

- Enter details of investments (80C: LIC, PPF, ELSS; 80D: Mediclaim, etc.).

- Choose between the Old vs New Tax Regime.

Step 6: Verify Tax Computation

- The system auto-calculates tax payable/refundable.

- Check carefully — correct any missing entries.

Step 7: Pay Any Balance Tax (if required)

- Use Net Banking, Debit Card, UPI, or NEFT to pay.

- Generate a challan (receipt) and enter details.

Step 8: Submit the Return

- Click “Preview & Submit”.

- Recheck everything. Once sure, hit “Submit”.

Step 9: Verify Your ITR (Mandatory)

- e-Verify via Aadhaar OTP, Net Banking, or Demat Account.

- Or send the signed ITR-V to CPC, Bengaluru by post (within 30 days).

Done! Your ITR has been filed successfully. You’ll get an acknowledgement email and SMS.

What are the Changes in ITR Filing 2025?

- Pre-filled forms (no more manual typing everything).

- Freedom to choose between the Old vs New Tax Regime.

- Aadhaar-PAN linking is a must.

- Faster, faceless processing at CPC Bengaluru.

Filing is now more digital, quicker, and easier.

Conclusion

Filing ITR is more than just a legal task. It’s about showing you are financially transparent, responsible, and future-ready.

Remember these two critical dates:

- 31st July 2025 – ITR filing due date for individuals.

- 15th September 2025 – Advance tax deadline (don’t ignore it!).

Delaying can cost you money, peace of mind, and opportunities.

Leave a Comment